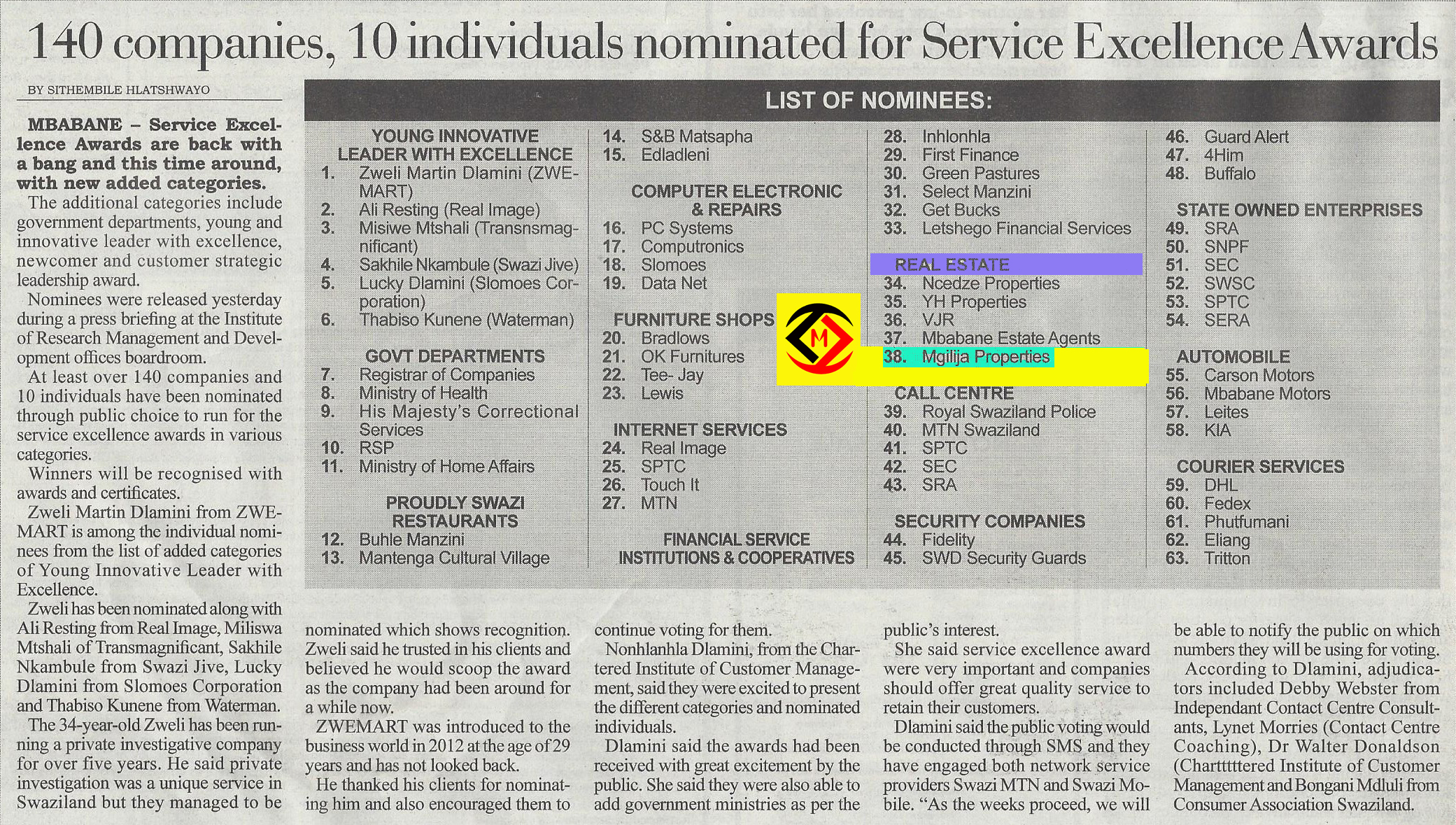

Understanding Open or Sole Mandates

When it comes to selling your property, which is better; open mandate or sole mandate?

A mandate is the instruction to a real estate agent with regards the commission. When a seller instructs an agent to sell his property for commission and the agent agrees, a mandate has been formed.

The question then arises as to whether a seller should use more than one real estate agent in order to sell their property faster. There are pros and cons to whichever choice you make.

Open mandate

If your property is listed as an open mandate, this means that any agent who has received a mandate from the seller may market and sell the property in exchange for commission. A seller in their private capacity may also attempt to sell the property. If a property is open mandate, no agent may claim the sole right to sell and market the property.

With so much competition to sell the property, most agents will be incentivised to sell the property at a lower price, just to make the sale. The sale may often be rushed and low-profit which is not great for the seller.

There is also such a thing as ‘double commission’ whereby it is not clear to determine which agent effectively made the sale. Most agents will not go all out and advertise a property that is under an open mandate.

Sole mandate

As the name suggests, no one except the seller and the sole agent may market and sell the property. This gives a focused point of authority but unfortunately means that the house may take longer to sell.

A plus for the real estate agent is that whether the seller sold the house or not, they will receive commission. It is usually the agent who makes the sale anyway, but this is a nice perk. A sole mandated real estate agent may also informally share the listing with other trusted real estate agents for a cut of the commission. Do not fret; you will not have to pay double commission should another real estate agent make the sale, nor will you receive increased communication from other agents – you will still only communicate with your sole real estate agent.

One or many real estate agents?

So which one should you choose to sell your property? This can depend on certain circumstances. Do you need to sell the property immediately? Or do you have time to wait for the price you would like in order to make a comfortable profit?

A sole mandated listing saves you from having to pay double commission when it

is not certain which real estate agent as in fact responsible for the sale.

Likewise, if you make the sale in your private capacity (a rarity) you will

still need to pay the real estate agent commission for all their efforts in

marketing, show days and appointments in order to sell your property.

A real estate agent can market from anything from a couple days to two years, so ensure that you do your homework when selecting a real estate agent. Great real estate agents give your listing maximum exposure and waste no time in getting people through the doors to view your property.

What is the voetstoots clause?

Most property buyers and sellers have a rather vague idea of what the voetstoots clause means and how it applies to them. This can lead to disputes if the parties don’t realise how it affects the offer to purchase and other property transaction documents.

What is the voetstoots clause?

In South African law the voetstoots clause is a standard term inserted into real estate – and many other – sale agreements. It says that the purchaser is buying the property or other item as it stands, whether or not it has patent or latent defects.

Patent defects refer to defects that are openly seen, discovered, or understood to be defects, whereas latent defects refer to hidden or dormant defects. Latent defects are more contentious because they often require a trigger to bring it to one’s attention, for instance roof damage that only becomes obvious after a bad storm.

The clause protects sellers in the event of latent defects coming to light after the transaction has been concluded. However, whether defects are patent or latent, if sellers know about them, they cannot use the voetstoots clause to protect themselves against repairing them or disclosing them to the buyers.

Sarah-Jane Meyer says the voetstoots clause still applies to property transactions when the seller’s ordinary course of business is not property, such as individuals who are selling their own houses or apartments.

Common issues

Sellers are required by law to disclose any latent property defects they are aware of. For the voetstoots clause to be set aside, buyers would have to prove that the sellers knew of the latent defects and deliberately concealed them with the intention of defrauding the buyers.

However, it can be very difficult – and costly – trying to prove that sellers deliberately withheld the information if problems are only discovered after the sale has already been concluded.

WHAT YOU NEED TO KNOW AS A FIRST-TIME LANDLORD

Building an investment property portfolio and becoming a landlord can be a great way of increasing your income or making a living, however being a landlord is not for everyone. While letting out property is a viable option for generating income, there is a lot more to being a landlord than signing lease agreements and collecting the rent.

Many landlords underestimate the amount of time and energy it can requires to ensure that a rental portfolio is maintained and tenants are kept happy. This does, however, largely depend on the tenants who are renting the property. There is also the matter of any legal issues and ensuring all legal requirements are adhered to and the right procedures are followed. This is especially important in the case where the tenant is not paying their rent. The correct steps need to be taken to deal with the delinquent tenant while protecting the landlord’s interests.

It is imperative for prospective landlords, as well as those who are already landlords to consider a few elements that will assist them along the way. There are five factors in particular that first-time landlords and those thinking about getting into the rental business should consider:

Plan and set a timeframe

Purchasing a rental property is not a get-rich-quick scheme. Property investment of any kind should be viewed as a medium to long-term investment. A property will appreciate over the long term and will generate a rental income, however, there might be costs that are not entirely covered by the rent, which is why the decision needs to be made with the future goals and plans in mind. There is a good chance that the rental property will pay for itself over time or when the market booms or when the bond is paid off, however in the initial stages there will probably be a cost involved.

Crunch the numbers

The monthly bond repayment is only one of a few monthly expenses that need to be considered. Affording a rental property is not just being able to pay the bond. When it comes time to crunch the numbers, landlords need to factor in expenses such as property insurance, rates and taxes, utilities, possible legal costs or collection costs, rental agent’s commission and general property maintenance.

Ideally, landlords will also need to have a contingency fund in place to assist with any unforeseen circumstances such as issues that are not covered by the home insurance or for legal costs if the tenant defaults on the rental agreement. There are also general legal fees for drawing up lease agreements or advice on the landlord’s legal rights and responsibilities. A lettings management agency can also be a highly effective tool for landlords to make use of. A rental agent can assist with vetting potential tenants, collecting rent and general management of the property.

Selecting the right tenant is crucial

Each prospective tenant should be put through a vetting process before they can let the property because the tenant will largely dictate the financial success of the rental. The tenant selection process is where the services of a rental agent will really pay off, as they will provide the landlord with the professional vetting of potential tenants. Factors that will need to be considered are the tenant’s previous rental history, reasons why they are moving, their place of employment and income. Agents should verify the information given by contacting the references provided by the tenant.

Contracts should be as detailed as possible

A highly detailed lease agreement that contains all the necessary stipulations upfront will help landlords to avoid any complications or misunderstandings regarding the responsibilities of each party. The more that is covered in the contract, the smoother the rental should run as each party knows exactly what is expected of them. No aspects of the rental agreement should be left open to interpretation, with the document covering aspects such as acceptable tenant behaviour, breakage costs, the preferred method of payment and date that the rental is payable.

Equally important is for the landlord to have a detailed agreement with the management agent should they decide to use one. The landlord will be able to sign a mandate with the rental agent which outlines all terms and conditions of the agreement, such as the commission structure and what is expected from the agent.

Having a checklist can save both time and money

The Agent should make a checklist of all the items that they need to look at and check before a new tenant moves into the property. The list will ensure that all potential problem areas can be sorted out and that a snag list can be drawn up with the tenant in a comprehensive manner.

Although owning a rental property and becoming a landlord can be hard work, it can also be the foundation to creating wealth over the long term. The key element to success is to always view property investment with the future in mind.

Valuations vs Surveys

Buying a house… is a valuation sufficient, or should you opt for a full structural survey?

Buying a house is probably the biggest financial purchase you’ll make in your lifetime and at a time when you’re already spending a lot of money, a survey can sometimes seem like a big expense. However, knowledge is power and it’s better to be informed of any potential issues before proceeding with the purchase otherwise it may end up costing you further down the line.

When you’re at the exciting stage of buying a new property it’s easy to get seduced by the appearance of your potential new home, and risk ignoring any hidden problems which could cost you later on.

That’s where a survey can give you peace of mind to purchase your new home with confidence. But with a number of options available, which is the best type of survey for the property you’re buying?

Mgilija Properties has summarised the different types of surveys available to help you make an informed decision:

A summary of surveys

The type of survey you should go for depends a lot

on the age and location of the property. For example, if you’re buying an older

property it’s sensible to select for a more detailed report than perhaps

someone who’s buying a new-build.

Basic mortgage valuation

The sole aim of the basic mortgage valuation is to

satisfy the lender that your chosen property is worth the price you’re paying

before they approve your mortgage. It doesn’t go into any detail on the state

of the property.

It’s important to remember that this survey is for the benefit of your mortgage lender and doesn’t provide you with any guarantees about the state of the property.

Homebuyers report

This is a detailed report for ‘standard’ properties

which are in reasonably good condition. It provides a more in-depth inspection

that will help you find out if there are any structural problems, such as

subsidence or damp, as well as any other hidden issues – inside and outside the

property. It will also give advice on any defects that may affect the value of

the property, along with recommendations for repairs and ongoing maintenance.

A homebuyers report excludes the cost of estimates for repairs.

Full

structural survey

Now known as a Building Survey, this is a comprehensive report providing a full

breakdown of the fabric and condition of the property, with diagnosis of

defects and repairs and maintenance advice. Typically these types of surveys

are more suitable for properties that are listed, have an unusual construction,

or require significant renovation.

Valuations vs Surveys

Buying a house… is a valuation sufficient, or should you opt for a full structural survey?

Buying a house is probably the biggest financial purchase you’ll make in your lifetime and at a time when you’re already spending a lot of money, a survey can sometimes seem like a big expense. However, knowledge is power and it’s better to be informed of any potential issues before proceeding with the purchase otherwise it may end up costing you further down the line.

When you’re at the exciting stage of buying a new property it’s easy to get seduced by the appearance of your potential new home, and risk ignoring any hidden problems which could cost you later on.

That’s where a survey can give you peace of mind to purchase your new home with confidence. But with a number of options available, which is the best type of survey for the property you’re buying?

Mgilija Properties has summarised the different types of surveys available to help you make an informed decision:

A summary of surveys

The type of survey you should go for depends a lot

on the age and location of the property. For example, if you’re buying an older

property it’s sensible to select for a more detailed report than perhaps

someone who’s buying a new-build.

Basic mortgage valuation

The sole aim of the basic mortgage valuation is to

satisfy the lender that your chosen property is worth the price you’re paying

before they approve your mortgage. It doesn’t go into any detail on the state

of the property.

It’s important to remember that this survey is for the benefit of your mortgage lender and doesn’t provide you with any guarantees about the state of the property.

Homebuyers report

This is a detailed report for ‘standard’ properties

which are in reasonably good condition. It provides a more in-depth inspection

that will help you find out if there are any structural problems, such as subsidence

or damp, as well as any other hidden issues – inside and outside the property.

It will also give advice on any defects that may affect the value of the

property, along with recommendations for repairs and ongoing maintenance.

A homebuyers report excludes the cost of estimates for repairs.

Full

structural survey

Now known as a Building Survey, this is a comprehensive report providing a full

breakdown of the fabric and condition of the property, with diagnosis of

defects and repairs and maintenance advice. Typically these types of surveys

are more suitable for properties that are listed, have an unusual construction,

or require significant renovation.

Landlords: Your Student Accommodation Checklist

Pivoting your investment property towards providing student accommodation could prove very lucrative. Here’s how to get it right.

Student living

Think back to your tertiary education years, and you might consider them the best years of your life. Filled with learning, new experiences, friends, and fun, living the student lifestyle is one that you remember with fondness. You remember the all-night cram sessions and camaraderie over late-night pizza. Now that you’re older, wiser, and have used your knowledge to invest in property, you’re considering creating that environment for our country’s future leaders.

Investing in student accommodation

Off-campus, privately-owned student accommodation is a huge attraction for students. Free of the on-campus rules and regulations, students are keen to start their student life with the right type of facilities at home. This type of property is always in demand, so if you’ve bought an investment property that’s situated close to a tertiary education facility, you could create a good source of income for yourself. Alternatively, if you’re considering taking the leap into being a landlord, here’s how to get it right.

Play by the rules

Before you make that purchase, or adapt your investment property towards student accommodation, make sure your property is correctly zoned and has adhered to the right regulations in terms of facilities too. Your ability to turn your investment property into student accommodation will also be affected by your neighbouring properties, so make sure there have been no objections to your plans. It’s also a good idea to speak to your nearby tertiary education institution’s student housing office, and enquire about getting listed on their student accommodation database. They can be a great resource for finding out more about their students’ needs.

Converting your property

Turning your property into the ultimate student home will take some work. You may need to add a bathrooms, sub-divide rooms, or extend your property. Before you start planning that funky mural, and installing a pool table, decide how many people your property will accommodate, and build accordingly. Overcrowding is all too common in student accommodation facilities, and could land you in trouble with the law, so don’t be tempted to take on more students that you can.

Insuring your property

According to privateproperty.co.za, don’t forget: when you’re all set up and ready to welcome your first student tenants, you’ll need to update your property’s insurance policies. Chat to your financial advisor or insurance broker about your additional insurance needs.

Get your property student-ready

Location is a life essential when it comes to student accommodation. Make sure your property is situated along, or near to, public transport routes. If your investment property is a house, then creating common living areas, including a TV lounge, dining area, and perhaps a ‘chill spot’ is important. Make sure each room is equipped with at least one desk per student, and allows for everyone to enjoy some quiet time when they need to study. Of course, it’s 2019, and none of us could survive without WiFi. Invest in the highest speed internet connection you can, and ensure your network can easily sustain your residents’ needs.

The bonus features

Turning your investment property into the ultimate student abode will mean adding in a few bonus features. If it’s possible for you to add in selected extras, you will be able to demand a higher rental amount from your tenants. Consider adding in-house catering facilities, a swimming pool, or other recreational facilities, if you can.

Keeping an eye on things

As a landlord, you are legally responsible for maintaining the property, and ensuring that all rules and regulations are adhered to by your student tenants. Respond to their enquiries promptly, and deal with complaints as quickly as possible. Don’t forget to conduct regular property inspections, once you’ve arranged a convenient time and date for your tenants.

Mgilija Properties can assist with advice on how to go about with such management

Does paying E100 extra on your home loan matter?

The substantial amount of debt owed on a home loan can often startle consumers making it seem pointless to pay anything extra, as it may take decades to settle the amount outstanding.

The substantial amount of debt owed on a home loan can often startle consumers making it seem pointless to pay anything extra, as it may take decades to settle the amount outstanding.

By paying E50 extra on a E500 000 Home Loan on a 10.25% interest rate for 20 years, you will be able to pay off your home loan in 19 years and three months, while saving over E26 111.86 in interest that you would have paid to the bank.

Dr Simphiwe Madikizela, says what many consumers don’t realise is that even paying as little as E50 extra on your bond, you can immediately start saving on interest.

By paying E50 extra on a E500 000 Home Loan on a 10.25% interest rate for 20 years, you will be able to pay off your home loan in 19 years and three months, while saving over E26 111.86 in interest that you would have paid to the bank.

He says that in order to understand the impact of extra payments, consumers should first be able to distinguish between payment towards their principal debt as well as interest paid on the principal debt.

For a home loan, the first payment you make would typically be paid towards interest. However, any extra payment you make enables you to lower the principal debt owed. As the principal debt decreases, so does the amount of interest you have to pay.

Madikizela demonstrates the impact of making an additional payment, every month, on a E500 000 home loan at an interest rate of 10.25 % for 20 years:

| Recurring extra payment monthly | Years to be paid off | Savings on Interest |

| E100 | 18 years and 8 months | E49 933.77 |

| E200 | 17 years and 7 months | E91 913.82 |

| E300 | 16 years and 8 months | E127 859.91 |

| E400 | 16 years | E159 093.56 |

| E500 | 15 years and 3 months | E186 545.30 |

| E600 | 14 years and 6 months | E210 921.07 |

| E700 | 14 years | E232 744.92 |

| E800 | 13 years and 5 months | E252 426.89 |

| E900 | 13 years | E270 280.29 |

| E1000 | 12 years and 5 months | E286 571.73 |

“You should also consider topping up your extra payments with a lump sum, either from your bonus or tax refund, etc. This will significantly reduce your interest over the loan period.

“Being aware of the impact of making extra payments will help you manage your bond repayments and ultimately ensure that you pay off your bond as quickly as possible,” says Madikizela.

How to spot a property bargain in Eswatini

There are many factors besides price that astute buyers will consider before investing in property. Here are 6 factors to keep in mind.

There are many factors besides price that astute buyers will consider before investing in property. Here are 6 factors to keep in mind.

Fortunes have been made by investing in property but, and there is a very big but, generally it’s only those who truly know how to capitalise on a situation that make pots of money.

So what is the secret to buying property at a bargain-basement price and more importantly, does it mean you’re guaranteed to make money simply because you managed to snap up a home for what you consider a ridiculously low sum? The short answer is no. There is so much more to buying a property than price, and there are several other important things to take into account before signing a sales agreement.

Research

It is vital to have a good understanding of the market you are buying into. Markets change from area to area and sometimes even from street to street. Don’t rush into something simply because the deal looks good – take a long hard look at the area, investigate what’s been sold there and at what price and then make an informed decision. Demand drives prices, so buying a property with a rock-bottom price tag in some far flung area where the demand is low will probably come back to bite when it comes time to sell. At the same time, expecting to make a serious profit from a sale in an area which has a glut of properties on the market could also backfire and you could end up losing out. Consult with local estate agents in order to get a clear picture of the local market conditions and only invest once you have all the facts at your disposal.

Keep your eyes peeled

Bargains come onto the market every day and are generally snatched up quickly. Scour estate agents’ websites daily and subscribe to their newsletters in order to receive instant alerts when something new comes onto the market.

Read the fine print

Keep an eye out for legal notices and note which homes are being repossessed. Go and view the home before the sale.

Handyman’s dream

Many ‘bargain’ properties are marketed as needing a little TLC and indeed there are properties which have been bought for a song because work needed to be carried out before the owner could move in. The big question here has to be how much work it’s going to take to get the home habitable, and at what cost. Do the maths before you buy.

Price is king

A listing that’s been on the market for a lengthy period without a drop in price is unlikely to be a good buy for those seeking a bargain. This is because these sellers are usually unwilling to negotiate – those who are desperate to sell will lower the price if there are no takers which generally makes them more willing to negotiate in order to get the property sold says www.privateproperty.co.za

Don’t delay

Once you’ve done your homework and recognise a good deal when it presents itself, act on it as soon as possible. Remember there are others who, like you, want to bag a good deal and those who dither could end up losing out on the bargain of a lifetime.

8 things to check before renting an apartment

Finding a new apartment to rent can be an exciting and promising time for any tenant, whether you’re new to the rental game or an experienced player. But jumping head first into a new lease without first carrying out an in-depth walkthrough could leave you with a fair amount of unnecessary woe to deal with.

Finding a new apartment to rent can be an exciting and promising time for any tenant, whether you’re new to the rental game or an experienced player. But jumping head first into a new lease without first carrying out an in-depth walkthrough could leave you with a fair amount of unnecessary woe to deal with.

Tenants should always insist on viewing a property before signing on the dotted line. Besides being able to spot potential issues, you will avoid the risk of falling for rental scams. Not only is signing a lease without viewing the apartment ill-advised, tenants often run the risk of falling for rental scams when doing so.

Below is a list of things to pay close attention to while viewing a potential apartment:

- Doors and windows

Be sure to check that all the doors and windows open and close easily, especially sliding doors! Also make sure that the doorknobs aren’t wobbly and that the locks work. If any locks are broken or missing, be sure to bring this to the landlord’s attention so that you feel safe should you choose to move in. It’s also worth taking note of any draughts or sealing issues as this could make a difference to your electricity bill when it comes to heating or cooling the apartment.

- Walls and floors

While a small crack in the wall isn’t anything to be too concerned about, any crack that you can slide a 50c coin into could be a sign of bad structural integrity. In fact, spotting any structural flaws should serve as a warning to rather set your sights elsewhere.

Also, be on the lookout for any water damage or watermarks near the floorboards, on ceilings, and on the walls. Water damage indicates that something is leaking somewhere, which means that mould, mildew, or rot could set in if it hasn’t already. This could pose a serious health risk especially for those prone to allergies or respiratory infections.

- Appliances

Although most apartments in Eswatini come unfurnished, it is worthwhile checking that all supplied appliances are in good working order.

Check that the stove plates and/or gas hobs work and that the oven heats up and is free of grease or cooking build-up. Also, be sure to check that the fridge is cold, if one is provided, and if there’s a washing machine and tumble dryer, look inside to make sure that these too have been well maintained.

- Consider your furniture

A common mistake tenants make is signing the lease on an apartment before checking if their furniture will fit in come moving day. One sure way to avoid this is to measure all big-ticket items like beds and couches before viewing the apartment so that you have an idea of whether it can fit as well as how things can potentially be configured should you choose to move in. It may even be worthwhile taking along a tape measure to measure the floor space for even greater accuracy.

- Cellphone signal

It might sound unlikely in this day and age, but some areas still don’t have the best cellphone reception. With this in mind, take a moment to check your phone’s signal and connectivity during your walkthrough. If the lease includes WiFi, ask the landlord to demonstrate that it works and that it is currently connected with a strong signal.

- Crime

Living in a country where crime is an everyday concern means that it’s important to get to know the area you could end up living in. Check the security features of the apartment i.e. is the property access controlled by a guard or does it have an alarm system. It’s also worthwhile finding out where the local police station is and asking them, or even existing tenants, what crime is like in the area. If they are unable to assist, a simple Google search might help give you a good idea of any crime statistics and reports.

- Parking

If you own a car, parking arrangements should definitely be on your list of things to check out. In many neighbourhoods – especially in the city – street parking can be hard to find or unsafe for both you and your vehicle. Finding an apartment with a garage and/or an inside parking bay is therefore a necessity. Remember to ask whether the apartment comes with allocated parking and whether there is an additional cost for this.

- Noise levels

Before leaving, take a moment to listen to the neighbourhood and surrounding noise levels. Note how loud the traffic is, whether there are barking dogs or how easy it is to hear your neighbours. If you really like the apartment, try visit more than once and spend some time in the surrounding neighbourhood during the day and night. You may find that it’s much noisier at night, for example, so this will give you a better idea of what you’re in for.

While these are just some factors to be aware of when flat-hunting, there are many others – like checking for signs of pests, making a note of how easy the apartment was to find, looking at the upkeep of communal areas etc. Considering these factors when viewing potential apartments can help you find the right apartment and ensure that you aren’t caught off-guard later.

Once the lease is signed, you’re in it for the long haul so make sure that the apartment you choose doesn’t have any major issues that will make lead to renter’s regret.

Beware the agent who hijacks listings

Imagine putting your home on the market for a specific sum and then discovering that another agent has not only hijacked the listing and is marketing your property without your permission, but is doing so at a much lower price.

Imagine putting your home on the market for a specific sum and then discovering that another agent has not only hijacked the listing and is marketing your property without your permission, but is doing so at a much lower price.

As incredible as it sounds this type of behaviour is apparently becoming more prevalent. Of course, there is a chance that this has been happening for years, but without the endless reach of the Internet it was just a lot harder to spot. Regardless, the practice needs to be stopped.

The big question has to be why certain agents do this?

There are two main reasons: there’s always the chance that a desperate seller may accept a lower offer and it attracts buyers. Agents need both buyers and sellers and the more of both they have, the greater their chances of making a sale. Unscrupulous agents who fraudulently advertise a property know they probably won’t be able to convince the seller to accept the lower offer, but they also know there will be other homes which could appeal to the buyer. In other words, these properties are nothing more than bait and once the buyer has been lured in by the ‘fake’ listing, the agent shows the legitimate listings in the hope of making a sale.

And these agents don’t only manipulate the price, says www.privateproperty.co.za. “The descriptions of the homes in ‘fake’ listings are often changed or embellished in order to attract buyers. When these discrepancies are queried by the prospective buyer, the agent claims they are ‘typographical errors’.”

Apart from wasting time, this practice could be dangerous. Firstly, one has to question how trustworthy an agent can be if they are willing to fraudulently advertise a home? The other aspect that must be considered is that it’s highly unlikely the agent has actually visited the home and is thus probably unaware of any latent or patent defects.

However, there are even greater risks to the seller.

“The damage this type of behaviour can cause the seller can be catastrophic. It stands to reason that buyers will question the validity of a listing if they see it advertised at different prices,” says www.privateproperty.co.za. “We all make assumptions and in these instances buyers will often assume that the seller will be willing to accept a lower offer and so won’t be willing to pay the higher price, even if they can afford to do so.

“Despite having ‘sold’ the property, the hijacking agents are rarely acting in the seller’s best interests. They are working purely for the buyer and the offer to purchase will often reflect that.

The hijacking agent rarely knows the property, and will have to recreate a disclosure report, or not be able to produce one at all, which could lead to:

- Offers lower than the advertised price.

• Buyer’s remorse due to the fact that the purchaser is not aware of latent or patent defects, which can result in cancelled offers.

• Sellers being charged double commission. This is a real danger. There’s a good chance that the buyer won’t reveal that he has already viewed the property when advertised at the higher price, which could lead to all sorts of problems if it’s ruled that the agent who first showed the property was the effective cause of sale.

“Unfortunately sellers, particularly those who have signed a sole mandate with a particular agency, are often unaware that their homes are being ‘illegally’ advertised by other agents. However, alarm bells should be triggered if they start to receive lower offers from other agents. My advice to those who discover their homes are being falsely advertised is to bring the matter to the legitimate listing agent’s attention and instruct them to contact the agent who has hijacked the listing, and any platforms which are advertising the property. In the event of a private sale, the seller should contact the agent and the advertising platform.

Agents who become aware of the problem should contact the hijacker to discuss the illegal listing and ask that the advert be removed. The phone call should be followed up with an email to the advertising platform (with the relevant mandate agreement) requesting the removal.

Although the practice of fraudulently advertising properties is not linked to race, sex, location or agent status (principals have been known to steal listings as well) part of the problem lies with the fact that a growing number of agents and agencies are not registered companies. It’s imperative for buyers and sellers to only work with agents who are registered do work from the boots of their cars.

Budget-friendly kitchen renovation tips

A kitchen makeover can add exceptional value to your home but it doesn’t have to cost the earth. Have a plan and budget in place to ensure you get the best value and quality.

A kitchen makeover can add exceptional value to your home but it doesn’t have to cost the earth. Have a plan and budget in place to ensure you get the best value and quality.

Kitchens are the heart of a home but more than that they are a commodity – they add value and as a rule – they come with a big price tag! This is not a room in the house that you can keep changing as trends come and go – annual impulse updates are just not affordable. That said, according to privateproperty.co.za, if you plan and budget before embarking on a kitchen makeover – you can make sure you get the best value for money without cutting corners and quality.

Making every cent count – so you can live with and love your kitchen – starts with the appointment of a reputable supplier for the job.

Evaluating what you can save from your existing kitchen is another smart way to minimise the bottom line – freeing up budget for other improvements.

Keep Your Carcasses

If your kitchen cupboard carcasses are still in a good nick – consider simply changing the doors, reworking your colour scheme and fitting funky new handles. You can even do the installation yourself. Installing doors doesn’t require that you have a degree in DIY – it’s actually quite simple.

Should you decide to simply replace the doors – it’s a good idea to take the old ones in to ensure the dimensions for the new doors are 100% accurate. Alternatively – use a measuring tape with 1mm increments and measure the reverse of the doors; they normally have square edges which makes them easier to measure more precisely.

Although you might be trying to keep costs down – be sure you don’t cut costs when it comes to your hardware. Only use high quality runners and hinges; they work hard and if the average lifespan of a kitchen is 15 odd years – you want these parts to last. There’s nothing more frustrating than constantly replacing hardware and the joy you will experience from a marginal saving will quickly be replaced with the disappointment of bad quality runner.

The advice on hardware is to purchase a quality hinges, including a baseplate with either 8mm grommets or euro screws as they won’t pull loose or rip out of the carcass sides as easily as the cheaper alternatives. He says that the modern hinges allow for up to 3mm adjustment – up and down – in and out. It’s advisable to get your door supplier to pre-drill the hinge holes though so enquire about this service. Handle positioning is a personal choice – so this must be done on site.”

Door to Drawer Ratios

If your current kitchen isn’t outfitted with many drawers before you begin your kitchen makeover – review the door-drawer ratio. While it’s all about personal preference – it goes without saying – drawers are much more practical and it’s advisable to have as much as 60% of your floor units as drawers. With cupboards you have to get on your knees to look for items stored at the back – while drawers provide access to the contents without having to unpack them first.

Doors in Vogue vs Personal Preferences

When selecting your new doors – go for styles that are timeless yet classy. A Venice Semi-Solid Door – also known as a shaker door – is a good option that’s ageless and will have widespread appeal. This look works in both a natural wood finish and a painted MDF (medium density fiber board) option. Adding to this he says that one of the most popular cupboard choices currently is doors with integrated handles – or handless options.

Don’t be swayed by popular opinion though – you need your home to reflect your personality and if the rest of the house is more traditional – then this change could look out of place. The same applies to the current on-trend finishes: white oak, with a natural effect paint gives an “unfinished” natural feel and is great when combined with grey. It’s true – two-tone oak and colour combining is stylish and in vogue but if this doesn’t resonate with you – don’t do it. The same holds true if your home is open plan; make sure your new kitchen will work with the room it flows into.

Focal Features

Another way to add something to this room that’s very on trend – is to commission just one central feature like a statement island. The rest of the kitchen can be made over by simply replacing the doors but allocating the bulk of your budget to the new focal point will give the appearance of a more extensive makeover. You could also use granite on the island and a cheaper timber or laminate for the other counters – it’s about being clever so you can stretch your Emalangeni further.

Final Effects

A kitchen can also be transformed by adding a coat of fresh paint to the walls – an accent wall goes a long way towards a new look without a hefty price tag. You can also consider introducing a new splash back with a funky tile to mix things up. Purchase some new bar stools (or use what you have but paint half of the legs in the colour of your new cupboards) to tie the new look together. New taps, light-fittings and countertop accessories can be included in your budget – even if you only introduce at a later stage. These updates will refresh the final finish and go a long way towards creating your dream kitchen.

Renting? This is what your landlord wishes you knew

Tenants often feel that landlords are unreasonable, especially when it comes to the payment of rent. The reality is that most landlords simply cannot afford to carry a non-paying tenant.

Tenants often feel that landlords are unreasonable, especially when it comes to the payment of rent. The reality is that most landlords simply cannot afford to carry a non-paying tenant.

Rent may take a chunk out your salary, but this doesn’t mean that the landlord is making a huge profit at your expense.

Most people who invest in a buy-to-let property do not do so because they want to get rich quickly. This is because, as a rule, property has never been regarded as a quick fix and investors generally invest in real estate for the long term.

Lea Jacobs from www.privateproperty.co.za says numerous landlords believe that the person who rents a property has far more rights than the person who owns it, tenants still tend to think that landlords go all out to rip them off.

There are of course unscrupulous landlords who despite increasing the rent on an annual basis, refuse to maintain the property. However, it can be said with a certain amount of confidence that there are tenants who expect far too much from their landlords and complain and demand on a continual basis.

Generally speaking, all a landlord wants from his tenant is for the property to be maintained to an acceptable standard and for the rent to be paid on a monthly basis. Unfortunately, there are those who think that the landlord is responsible for everything that goes wrong in the home including (and this is a genuine case) replacing old light bulbs.

Rent will always take a huge chunk out of anyone’s salary, however this does not mean that the landlord is raking in the cash and making a huge profit at the tenant’s expense. It costs money to own a home – apart from on-going maintenance issues, bonds have to be serviced and rates have to be paid. Despite all of this, it is most often cheaper to rent than to own a home of your own – at least in the short term.

Renting out property is not a personal exercise, it’s business and the average landlord cannot afford to carry a defaulting tenant. They have bonds and rates to pay and neither the banks nor the municipalities are interested in why their accounts haven’t been paid – they simply want their money.

A landlord may well be compassionate about the fact that a job has been lost or that a tenant has been ill – this does not detract from the fact that he needs the monthly rental on time, every time. It may sound harsh, but landlords should never have to resort to evicting a tenant. Those who can’t pay, should simply move out and find a more affordable place to live. Unfortunately this doesn’t always happen mainly because the tenant believes that the landlord owes him something and he therefore has every right to stay in the property until he gets back on his feet.

Everyone needs a roof over their heads and paying rent should be the first thing that tenants concentrate on by paying at the beginning of the month. Think about it, it’s pretty pointless having a budget for food if you haven’t got anywhere to cook it. Likewise, looking great in the latest fashions may make you feel good, but it’s a bit of a waste of time if you don’t have cupboards in which to store the clothes.

Buy to let vs Buy to live

The criteria for buying a property may change depending on what you are planning to use it for, says www.privateproperty.co.za

The criteria for buying a property may change depending on what you are planning to use it for, says www.privateproperty.co.za

Investing in a property you are planning to let out (buy-to-let) criteria:

While the neighbourhood you choose to buy in for this purpose is important for reasons such as rental demand and resale value, you don’t necessarily have to personally like the neighbourhood, nor does it have to be close to your place of work as you are not planning to reside there yourself.

If the property you are buying for investment purposes needs work done in order for it to be in a “rentable condition” you will probably have a tight time frame in which to complete any corrections or alterations before running the danger of ending up with a vacant property. When you own a buy-to-let property you should always keep it in a good condition to ensure that there is adequate rental demand for it.

Strong rental demand in the area is vital.

Like in the case of buying a property to live in you need to determine what the rates, taxes and monthly levies (if any) will be because this is payable by you (the owner). Also consider whether you will be able to service the bond even if you do end up with a vacant property for whatever reason and keep in mind that monthly levies could be high.

Investing in a property you are planning to live in criteria:

While personal preferences aren’t as important when investing in a buy-to-let property, compromises are harder to make when buying a property you are going to live in. You should be able to see yourself in a buy-to-live-in property on the long term and therefore it is crucial that you like the property and feel comfortable with the amount of bedrooms, neighbourhood etc. Likewise the property you live in should also be in close proximity to your place of work and the activities and amenities you regard important.

While the property you live in also requires effort you have a longer time frame in which to complete any alterations, additions or renovations because you will not be inconveniencing any tenants (only yourself).

Rental demand is not as important as with buy to let property. Resale values are however, especially if you are not planning to reside there forever.

In addition to rates, taxes and levies you will need to pay the bond as well with no rental income from tenants. Will you be able to afford it?

5 tips for first-time millennial landlords

There are certain times in life when you want to settle down and others when you know it is time to move on, to a different job, different town or different home that better suits your current needs.

There are certain times in life when you want to settle down and others when you know it is time to move on, to a different job, different town or different home that better suits your current needs.

One of the hardest things to do as a landlord is to determine a rental that is competitive but still profitable. And according to recent research, many millennial homeowners in their 30s are now reaching the stage where they are ready to sell their first home and move on to another property, which is usually bigger, to accommodate a growing family and a more suburban lifestyle.

Greg Harris, says this is good news for current property sellers because it means an increase in the number of potential buyers coming into the market again. But, he says they also see an increasing number of young owners trying to decide if they should keep their first flat or townhouse as an investment and rent it out.

“Our advice is that this is generally a good idea if the bond on the property is very low or paid off, because most of the rent coming in every month will be additional income and could help you qualify for a bigger home loan for your new property or enable you to pay off your new loan in a shorter time and save thousands of Emalangeni in interest.”

According to Harris, having two properties will also give you more collateral and should improve your credit rating. And traditionally, he says buying a second home while letting your first one has been a good way to start building up a real estate investment portfolio.

However, he says, if you do make this choice, you should also make sure you get help from a professional managing agency to advertise, let and manage the property, and from a qualified accountant to make sure you don’t get in a tax tangle with SRA.

Harris shares top tips for millennial first-time landlords…

The rental market can be very competitive, so your flat or townhouse must “make a great first impression, in photographs as well as in person”. It should be super clean, painted in neutral colours and completely decluttered.

- Make your property as ‘rentable’ as possible

The rental market can be very competitive, so your flat or townhouse must “make a great first impression, in photographs as well as in person”. It should be super clean, painted in neutral colours and completely decluttered. But you also need to ensure that absolutely everything is in working order. Other major attractions are modern bathrooms and kitchens, high-end appliances and loads of storage space throughout.

- Determine your target market

One to three bedroom homes in security complexes are usually easier to let than large homes, because the demand is higher. However, you should work with your managing agent to research who the prospective tenants are in your area, the types of properties they want and what features of your home you should highlight to attract them.

- Set the right rental

One of the hardest things to do as a landlord is to determine a rental that is competitive but still profitable. Rental rates vary enormously, even within the same area, depending on the size of the property, popularity and security of the complex, proximity of shops, schools and other amenities, levies, insurance costs and a host of other factors. A reputable managing agent will have the market knowledge and experience to help you through this minefield.

Working with a professional managing agent like Mgilija Properties will substantially limit your risk and help you recover faster if the worst does happen.

- Prepare for the worst

Being a landlord can be difficult. Unexpected repairs, accidental property damage, unpaid rent and finding a new tenant can really set you back financially and take up a lot of your time. But working with a professional managing agent will substantially limit your risk and help you recover faster if the worst does happen.

- Don’t complicate your tax situation

Rentals received must be declared as part of your income, but you can claim certain expenses as a landlord. Your best move is to consult your accountant to get the calculations right and to work out what the capital gains tax implications will be if you decide to sell your rental property at a later stage

5 things to know before signing a Lease Agreement

… A lease agreement is a binding document and should not be entered into lightly

… A lease agreement is a binding document and should not be entered into lightly

Definition of Lease Or Tenancy Agreement: A tenancy or lease agreement is the basic grounding for probably the single largest monthly, or annual in the case of Swaziland, transaction that a tenant will make. It is important to understand that leases are subject to national legislation and that consumers cannot contract out of the basic rights that are assigned to them by law.

Therefore, it is critical to the smooth running of any tenant-landlord relationship that the lease is properly constructed and that it is legally correct. A lease agreement is a binding document and should not be entered into lightly. Tenants and landlords should, therefore, read carefully and be certain of what they’re going into before renting, buying or leasing a house. Here are five tips on what to look out for when signing a lease agreement:

- No additions or modifications outside of the lease

It is best practice to have the lease written with all provisions included. That way it can always be referred to in case of a breach on the part of either of the parties entering into the agreement. It is always best practice to not only reduce leases to writing but to also ensure that the lease is clear about the fact that no additions or modifications to the agreement can be made outside of the lease.

Always look for a clause that insists that any deviation from the terms should be agreed to by all parties in writing, otherwise you could end up in a situation where ad hoc changes are made verbally and bind all the parties involved.

- Leases are subject to national legislation

It is important to understand that leases are subject to the constitution of the land and that consumers cannot contract out of the basic rights that are assigned to them by law. A landlord cannot, for example, put in the lease that should the tenant not pay then the water can be cut off or something ridiculous like the doors and windows are to be removed.

Even if the tenant signs such a lease it remains illegal for the landlord to do these things as they go against the basic rights to shelter as enshrined in the constitution.

- Care of bills and facilities

In the event, some facilities are shared, either among tenants or between tenants and the landlord, it should be clearly stated who is responsible for maintenance of the said facilities and if it’s multiple people, the ratio of responsibility in terms of payment of bills regarding the facilities or cost of repairs and maintenance. For instance, if there’s a water tank or reservoir that’s shared among tenants (in the case where there are multiple tenants in an apartment complex) it should be clear who should pay for refilling it and how much if more than one person has to pay.

- Period covered by the lease

This should be clearly specified and indicate the date from which the agreement takes effect so as to better calculate when the agreement expires. In most cases in Swaziland, the period the lease covers directly affect the amount of money to be paid monthly. A deposit is normally paid as a one-time advance payment (covering a year or more). Most lease agreements allows one to three months, in the event the landlord cancels the agreement sometime during the period agreed upon in the lease, to find a new place and otherwise get your affairs together and vacate the premises in good condition. That means landlords are obliged, even in the event of cancellation of the tenancy agreement, to allow you this space of time before they can forcefully evict you.

- State of the property at end of lease

Even though this is obvious to most people, it is good practice to include in the lease agreement, a clause that indicates clearly the state the landlord would like to receive the house at the time of the tenant leaving it. Generally, this should be in the same or in as close as possible a state as that in which it was handed over to the tenant. Anything outside of this would be irregular and both parties should be very certain about its implications before entering into it.

Those are our top five things to look out for in a lease agreement. But they are by no means everything. If there’s something else that’s very important we left out, please let us know in the comments.

5 top tips for successfully renting out your property

Rentals are expected to continue to rise slowly in 2018 as the challenges of home affordability and tighter lending criteria tighten their grip, but it’s a double-edged sword as the local market will come under increasing pressure from declining disposable income levels and people moving to Swazi Nation Land.

Rentals are expected to continue to rise slowly in 2018 as the challenges of home affordability and tighter lending criteria tighten their grip, but it’s a double-edged sword as the local market will come under increasing pressure from declining disposable income levels and people moving to Swazi Nation Land.

It’s essential to market on different platforms and to ensure photographs are professional, like this image of a three bedroom in Ezulwini which is in the market for E15million.

Landlords are not only facing stiffer competition in the marketplace, but also a growing risk of delinquency as consumers are squeezed further and further. It is therefore more important than ever to secure quality tenants and to do thorough credit checks, even for clients with high-income levels and unblemished credit ratings as the increasing debt-to-income ratio is putting pressure on consumers across the board.

Property24.com pinpoints the five key factors that significantly influence the calibre of tenant a property attracts and the time it spends on the market:

- Presentation

This is what first separates a property from the competition, and so it’s important that a home always be professionally photographed by a photographer with architectural or real estate experience. It is more expensive, which is why some agencies may skimp on this cost, so landlords must always be clear about their preference when it come to this.

- Marketing

Times are changing, and it is no longer enough for agencies to simply post your property on the internet and hope for the best. Social media plays an increasing role in exposing your property to its potential audience. Millennials are the emerging buying market, and the best way to reach them is through a medium they follow. However, it is a very competitive space, so your agent must be proficient on these platforms and willing to spend the necessary costs of ‘featuring’ your property. If not, your home will be lost in a vast sea of properties. Feel free to visit Mgilija Properties on Facebook (https://www.facebook.com/MgilijaProperties/) Tweeter – (https://www.tweeter.com/MgilijaProperties/) Instagram – (https://www.intsagram.com/MgilijaProperties/) or www.mgilijaproperties.com

- Professional agency

Select an agent like www.mgilijaproperties.com who is passionate and can take your property to the market with conviction and vigour.

Appoint a reputable agency with a history of successful rentals in your area. It should have a specialised rental division with an international footprint and relationships with top corporates, which is particularly important at the top end of the market.

- Professional agent

Select an agent who is passionate and can take your property to the market with conviction and vigour. Anyone can walk around a house pointing out the various rooms, but that is not someone who has your best interests at heart.

Additionally, property negotiations can be tough, with everyone looking to get a deal, so choose an agent with the courage to say “no”, and remember that the harder they fight to hold their commission is an indication of the level to which they will fight to get your rental each month and achieve a successful outcome should problems arise.

- Compliance

Find an agency that drafts a lease that is compliant with the laws.

While we have all heard the doom-and-gloom stories concerning property rentals, the reality is that the law makes every effort to protect the landlord in the event of a non-performing tenant.

However, one needs to make proper use of a lease agreement that covers all the aspects pertaining to rental properties, and an agency that understands these laws and drafts a lease that is compliant with the law.

It is therefore essential that investment buyers are savvy about where they purchase, and do their homework before choosing an area and a property. Landlords simply cannot afford to cut corners.

Get a home loan with these top tips

Its the new year and as always some resolutions involve buying property.

Its the new year and as always some resolutions involve buying property.

So when when applying for a home loan, it isn’t just the buyer’s ability to afford the property he or she wants to purchase, it is their credit profile as a whole that will be checked, i.e. their spending and past payment behavioural patterns.

It is said that only one in four bond applicants are successful in their applications, and potential property buyers do need to have at least 10 per cent to 20 per cent of the purchase price as a deposit as banks do not often grant 100 per cent bonds anymore.

This is done via a credit report score that shows how the buyer compares with other consumers. The credit score is a point system that uses factors such as how well the applicant pays their bills each month, whether they pay in full and on time, how much debt they have and how many times they have applied for some form of credit. This will ascertain whether the buyer is a suitable candidate for a long-term loan, or not.

The higher the score, the better, and consumers are usually given feedback as being fair, good or very good, up to excellent.

Many potential property buyers will possibly be asked if they have pre-qualified for a home loan.

If the applicant has no credit record, where the potential buyer has thought to keep his or her record clean and pay for all they have in cash, they will have to build a credit profile before the banks will consider the application.

When an application is to be submitted to the banks, they will also need three months’ proof of income, proof of current address, and identity documents. If self-employed they will need six months’ worth of bank statements or financial records to assess what the applicant’s income and expense patterns are.

Banks tend to go as far as two years back into the applicant’s credit rating, and any unpaid items will necessitate a six-month period to “rehabilitate” the rating. Each time an account is paid late or not in full, this affects the credit score negatively and a record is kept of this, which shows how important it is to pay all bills in full and on time.

Property24.com says, this sounds like it’s contradictory to good financial planning, but it only takes one or two small retail or credit card accounts to be opened, paid on time and in full each month for six months to show that the applicant is consistent with the upkeep of his or her financial commitments.

“It is better to check your own credit rating (and have that 100% in order), and have a pre-qualification certificate before looking to buy, as this clears the way to an easier application and approval process,” advises property24.com.

If your home loan is not successful because of a lower credit score or the lack of a 10 per cent or 20 per cent deposit, all is not lost.

Have you made any New Year’s resolutions?

Have you made any New Year’s resolutions?

Here at Mgilija Properties we have!

This year we resolve to continue to exceed the expectations of our clients with service beyond their wildest dreams.

If you have any suggestions as to how we can make our service more valuable to you, We would love to hear them. And if there is any way we can help you keep your resolutions, please let us know. We wish you a peaceful and prosperous 2018.

Email: info@mgilijaproperties.com

Website: www.mgilijaproperties.com

Tips to make homes more secure during the festive period

This festive season  Mgilija Properties wants home owners and tenants alike to ensure that they enjoy a safe and secure festive season. Despite the festive season being a few days the crime rate can shoot up in a matter of days, there are occasions when some residents become the subject of a crime. At this time of year one of the main areas of concern for every home owner is burglary. Homes can be vulnerable to burglars, particularly when they are unoccupied in the late afternoon and early evenings but residents can take some simple steps to make their homes more secure by following some simple advice:

Mgilija Properties wants home owners and tenants alike to ensure that they enjoy a safe and secure festive season. Despite the festive season being a few days the crime rate can shoot up in a matter of days, there are occasions when some residents become the subject of a crime. At this time of year one of the main areas of concern for every home owner is burglary. Homes can be vulnerable to burglars, particularly when they are unoccupied in the late afternoon and early evenings but residents can take some simple steps to make their homes more secure by following some simple advice:

- When leaving the house unattended make sure all the windows and doors are locked, pay particular attention to those at the rear of the house. Don’t forget to lock the shed and garage too.

- Make the house look occupied by using automatic timer switches on indoor lights either upstairs or in a room that cannot be peered into from the street.

- Using a timer switch with a radio tuned to a talk station also gives the illusion that somebody is home.

- Burglars like the dark so an outside automated light can act as a good deterrent.

- Make sure presents are kept out of sight and after presents have been opened, dispose of the boxes properly to ensure the contents of the house aren’t being advertised.

- Other tips include making sure that car keys are kept hidden out of sight and that keys to property aren’t left outside under a plant pot or door mat.

- To help keep the whole of the street safe, residents can get involved with their local Neighbourhood Watch Scheme.

- Looking out for neighbours means that burglars have to work much harder – for further information about joining Neighbourhood Watch contact your local police station to find out if there is one in your community.

- Finally residents are being urged to report any suspicious callers or activity to the police by dialing 999 or 9999 or if they believe a crime is taking place, giving as much information as possible.

You better save for a home deposit

We have been getting a lot of enquiries from future clients who either are at university or have just started working. All they want to know is about property and the possibility of them owning one one day. Our motto as Mgilija Properties is ‘‘don’t wait to buy property but Buy property and wait’’ and the first step to achieve this is before entering into the property market one should be saving towards a deposit. Buying your first home requires planning and saving. A deposit is very important as it gives potential home buyers the boost they need when applying for a home loan. If you have a deposit to put down, the Banks will take this into account and your affordability score will rise. AdditionalSave for a home deposit We have been getting a lot of enquiries from future clients who either are at university or have just started working. All they want to know is about property and the possibility of them owning one one day. Our motto as Mgilija Properties is ‘‘don’t wait to buy property but Buy property and wait’’ and the first step to achieve this is before entering into the property market one should be saving towards a deposit. Buying your first home requires planning and saving. A deposit is very important as it gives potential home buyers the boost they need when applying for a home loan. If you have a deposit to put down, the Banks will take this into account and your affordability score will rise. Additionally, your monthly home loan repayments will be lowered and depending on the relevant Bank’s criteria, you could be able to apply for a higher bond if you wish. Saving towards a deposit is a simple concept although it can seem difficult depending on your financial situation. However, it is like any investment plan; it takes time and patience. Start by drawing up a budget of your monthly expenses and deciding how much you can afford to save per month. You may have to make cutbacks on certain items, but in the end being able to put down a deposit will result in lower instalments and less interest over the loan period, making paying off your loan more manageable.

We have been getting a lot of enquiries from future clients who either are at university or have just started working. All they want to know is about property and the possibility of them owning one one day. Our motto as Mgilija Properties is ‘‘don’t wait to buy property but Buy property and wait’’ and the first step to achieve this is before entering into the property market one should be saving towards a deposit. Buying your first home requires planning and saving. A deposit is very important as it gives potential home buyers the boost they need when applying for a home loan. If you have a deposit to put down, the Banks will take this into account and your affordability score will rise. AdditionalSave for a home deposit We have been getting a lot of enquiries from future clients who either are at university or have just started working. All they want to know is about property and the possibility of them owning one one day. Our motto as Mgilija Properties is ‘‘don’t wait to buy property but Buy property and wait’’ and the first step to achieve this is before entering into the property market one should be saving towards a deposit. Buying your first home requires planning and saving. A deposit is very important as it gives potential home buyers the boost they need when applying for a home loan. If you have a deposit to put down, the Banks will take this into account and your affordability score will rise. Additionally, your monthly home loan repayments will be lowered and depending on the relevant Bank’s criteria, you could be able to apply for a higher bond if you wish. Saving towards a deposit is a simple concept although it can seem difficult depending on your financial situation. However, it is like any investment plan; it takes time and patience. Start by drawing up a budget of your monthly expenses and deciding how much you can afford to save per month. You may have to make cutbacks on certain items, but in the end being able to put down a deposit will result in lower instalments and less interest over the loan period, making paying off your loan more manageable.

Budgeting tip: A general guideline is to aim to have 20% of the property value available as this will also cover registration costs.

9 things that first time renters should know

Renting your first place can be intimidating. These tips for first time renters will help you go out there and flat hunt with confidence.

Renting your first place can be intimidating. These tips for first time renters will help you go out there and flat hunt with confidence.

Don’t forget to do your research: Moving into a home is a major life event, regardless of whether you are buying or renting – so it’s important to devote enough time and research into finding the perfect one. Embracing the digital age can be useful and you are almost always guaranteed to find whatever it is you are looking for online. The internet has a variety of property search portals that offer easy access to all available property listings on the market. You also have the option to sign up for instant alerts to keep track of all new listings on the rental market. www.mgilijaproprties.com is one such portal which instantly notifies users via the website of all new available listings.

Be mindful of rental scams: The downside to the digital age and its easy access to information is the opportunity it offers to bogus agents and fraudsters in generating rental scams that many renters fall victim to. Keeping your guard up is essential in ensuring you aren’t the next target of a rental scam.

The following are common signs to look out for:

- Not being able to view the place of interest

- Agents or landlords that avoid meeting in person

- A forced emphasis on transferring money without signing proper documents

- Holding back pertinent information from you.

Find out more on www.privateproperty.co.za on how you can avoid becoming victim of a rental scam.Renting a more expensive dwelling than you can afford is a common pitfall amongst many first time renters. First-time renters are advised to stick with a unit that is well within your price range in order to accommodate expenses you haven’t anticipated, like a huge utility bill or a broken appliance that needs to be fixed.Most rental spaces require a security deposit before moving in. The down payment is generally held by the landlord and can be used to pay for any possible damage to the property that you may cause whilst living in the apartment.

- The importance of a snag list: Making it a point to create an inventory of the property’s contents and existing damages before moving in can be beneficial. It is imperative to record every defect the property has regardless of how insignificant it may seem at the time. Ensuring a written lease is drawn up and understanding the contents of it is essential. It is crucial to understand the document before signing it to ensure that there is clarity on all the requirements and limitations set. We have all been guilty of agreeing to a list of terms and conditions without going through the trouble of reading it – but adopting the same attitude with your lease might not be such a good idea.

- Living with your furry friends: It’s also worth noting that pet-friendly rentals may be slightly higher in pricing to cover the costs of wear and tear that pets may have on the property. Stipulating the agreed upon pet terms and conditions in your lease agreement is essential to safeguard yourself and your pets. Whether you are living with friends or strangers, moving in with someone is an important decision to make and shouldn’t be taken lightly. Ensuring both you and your roomie have a joint lease to sign is essential. Not doing so can put you in a sticky situation if your roomie decides to skip town and stop paying, with you having to bear the brunt of the entire bill. You would be surprised at the number of things you need to have in order to live and if it’s your first time venturing out on your own then you’re bound to be short of a few essential household items. Making a list of all the daily requirements for your home is helpful in ensuring you settle in comfortably and have more time to enjoy your new place!

Moving into your own place for the first time means having more than just a bed, couch or a chest of drawers. Your own place to call home requires smaller basic items which every functional household needs, like a cutting board, a waste basket, shower curtain or even the necessary toilet brush and cleaning supplies.

Don’t forget home essentials: Finding someone who shares similar habits and behaviours, the same level of cleanliness and can afford their portion of the monthly expenses are important factors to reflect on. It may sound boring and tedious but weighing out these mundane specifics can make or break your living situation.

Pick the right roomie: To avoid any unwanted confusion and ensure no one gets left out in the cold, it’s important to notify your landlord in advance to obtain a clear indication of the rules and boundaries.

- If you are moving in with your pets, it’s important to ensure your property of choice accommodates for renters with pets and is a safe and viable space for your furry friends to live in.

- The fine print of a lease is just as important as it may include additional clauses that could have an unsettling impact on your wallet and lifestyle. These could range from penalties for late rent, policies on owning pets, painting or altering the rental space or what protocol to follow if something breaks and needs repair.

- A legally binding contract which spells out each of the rights, rules and regulations you and the landlord are expected to abide by whilst living in the space, is a must-have requirement for both parties.

Get everything in writing: By doing so you will be able to protect yourself and avoid any potential claims or unwanted disputes that could occur in the future.

- Deciphering who damaged what and who takes responsibility for it is a common contentious issue faced by most renters, especially when a deposit is being held to cover the cost of repairs.

- Taking excellent care of your new home is advisable to ensure your full deposit is refunded to you when your lease draws to a close. In addition to this, it may also be a requirement to pay a full month’s rent in advance for the property. Budgeting for this is crucial to ensure you have the necessary funds available to secure the keys to your new home.

Security deposits and upfront costs: Moving into a new apartment can often involve a lot of hidden costs that we sometimes forget to consider, so keeping some wiggle room in your budget is essential to avoid unforeseen bills and ensuring you aren’t living beyond your means.

Don’t live beyond your means: Always be wary and investigate as much as possible to avoid this type of situation from occurring. If you are dealing with a rental agent, ensure that they work for a reputable estate agency to confirm you aren’t liaising with a fraudster. It’s important to also have all relevant documents checked by a legal advisor to ensure all paperwork is legitimate.

What should you do when you can’t pay the rent?

If you’re frequently unable to pay your rent or late with your payment then it’s essential to follow these budgeting tips.

If you’re frequently unable to pay your rent or late with your payment then it’s essential to follow these budgeting tips.

It’s probably happened to most of us at least once: the rent is due, but you’ve blown your budget and you don’t have the money to pay the landlord.