Most of the time you will have a clear idea of when you will be moving homes and have time to plan and make decisions accordingly. However, there are times when life happens and the decision is made for you.

Most of the time you will have a clear idea of when you will be moving homes and have time to plan and make decisions accordingly. However, there are times when life happens and the decision is made for you.

Whether it be your company transferring you to another place, a family emergency that requires relocation, or maybe it’s to be with a significant other in another part of the country. In these situations, you will need to decide whether you are going to sell your home or rent it out.

Whether it be your company transferring you to another region, a family emergency that requires relocation, or maybe it’s to be with a significant other in another part of the country. In these situations, you will need to decide whether you are going to sell your home or rent it out.

According to www.property24.com , the following provides a few important considerations for homeowners who find themselves at this crossroad:

1. How permanent is the move?

Is the move for good or is it just for a time? If you are packing up and going for good, it makes sense to sell the property. However, if there is a chance you will be returning in a year or two, the time and money spent on selling the home and purchasing another won’t be worth your while. In that case, renting out the property seems like a far more feasible option.

2. Conditions surrounding the market

Do some research into what the rental prices are in your area, as well as the current selling prices of the homes. Also look at the demand for rental properties and the number of current listings available. Doing your homework will provide you with a much clearer idea of what kind of rental income you can expect, as well as what may need to be done to the home to get it up to standard if necessary. It is important that the achievable rental income is enough to cover the expenses. Otherwise, you will need to pay towards the home while paying for another property elsewhere.

3. Where is the area headed?

Aside from where the property is located, another influential factor when it comes to a property’s potential is the future development plans for the neighbourhood, as well as the condition of the neighbourhood.

Each situation is unique, so before you decide to rent out your home consider talking with a tax professional. They can help you figure out how much you can expect to pay in taxes on the rental income. While this aspect is completely out of your control, it will largely impact on the value of the home. Future development planned in and around the area can have a positive or negative impact on home values, depending on what the development is.

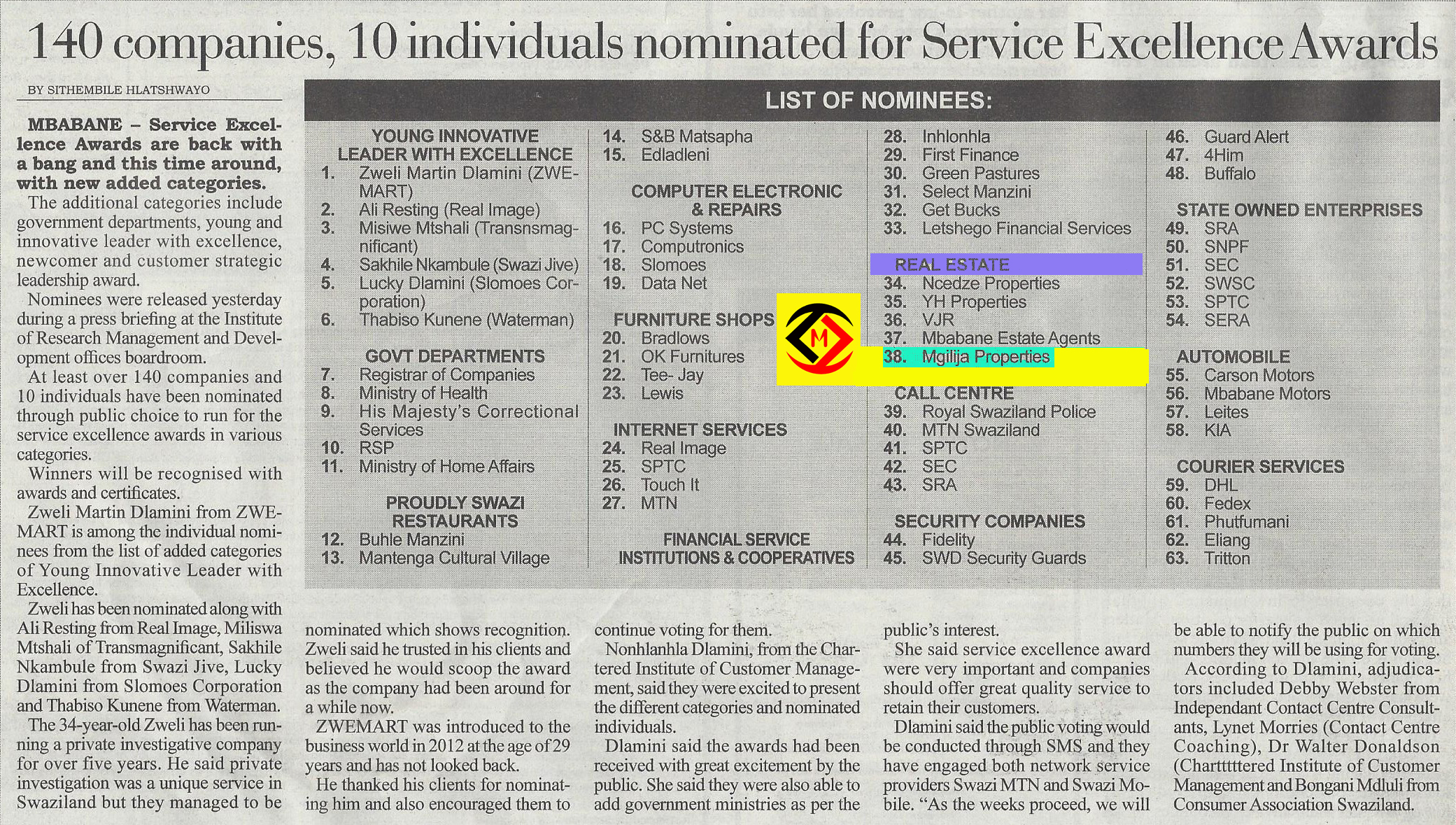

In this case a real estate agency like Mgilija Properties with specific area knowledge will be able to help you assess whether or not it might pay to hang onto the property or let it go.

4. Who will manage the property?

There is more to renting out a property than just collecting a cheque each month, and it is not for everyone. As a landlord there are certain obligations you will have to your tenants, which could include dealing with issues and emergencies in the middle of the night. You will need to ask yourself whether you have the time to manage the property or if you will need to hire a management agency like #MgilijaProperties.

In cases where the rental property is located in another region, a rental agent can provide a valuable service that will save you in travel costs. For a percentage of the rental income, a reputable rental agent will assist with advertising the property to rent, screening potential tenants and undertaking full credit checks, as well as drawing up the necessary lease agreements, among other services.

5. What are the tax implications?

Each situation is unique, so before you decide to rent out your home consider talking with a tax professional. They can help you figure out how much you can expect to pay in taxes on the rental income. In the case of Swaziland it is 10 per cent of the gross rental.

Finally

Deciding to hold on to the property and rent it out or sell it will depend on your circumstances and what will fit your needs and situation. Only you will be able to tell what option makes the most sense and will work for you.

Have you made any New Year’s resolutions?

Have you made any New Year’s resolutions?

Mgilija Properties wants home owners and tenants alike to ensure that they enjoy a safe and secure festive season. Despite the festive season being a few days the crime rate can shoot up in a matter of days, there are occasions when some residents become the subject of a crime. At this time of year one of the main areas of concern for every home owner is burglary. Homes can be vulnerable to burglars, particularly when they are unoccupied in the late afternoon and early evenings but residents can take some simple steps to make their homes more secure by following some simple advice:

Mgilija Properties wants home owners and tenants alike to ensure that they enjoy a safe and secure festive season. Despite the festive season being a few days the crime rate can shoot up in a matter of days, there are occasions when some residents become the subject of a crime. At this time of year one of the main areas of concern for every home owner is burglary. Homes can be vulnerable to burglars, particularly when they are unoccupied in the late afternoon and early evenings but residents can take some simple steps to make their homes more secure by following some simple advice: We have been getting a lot of enquiries from future clients who either are at university or have just started working. All they want to know is about property and the possibility of them owning one one day. Our motto as Mgilija Properties is ‘‘don’t wait to buy property but Buy property and wait’’ and the first step to achieve this is before entering into the property market one should be saving towards a deposit. Buying your first home requires planning and saving. A deposit is very important as it gives potential home buyers the boost they need when applying for a home loan. If you have a deposit to put down, the Banks will take this into account and your affordability score will rise. AdditionalSave for a home deposit We have been getting a lot of enquiries from future clients who either are at university or have just started working. All they want to know is about property and the possibility of them owning one one day. Our motto as Mgilija Properties is ‘‘don’t wait to buy property but Buy property and wait’’ and the first step to achieve this is before entering into the property market one should be saving towards a deposit. Buying your first home requires planning and saving. A deposit is very important as it gives potential home buyers the boost they need when applying for a home loan. If you have a deposit to put down, the Banks will take this into account and your affordability score will rise. Additionally, your monthly home loan repayments will be lowered and depending on the relevant Bank’s criteria, you could be able to apply for a higher bond if you wish. Saving towards a deposit is a simple concept although it can seem difficult depending on your financial situation. However, it is like any investment plan; it takes time and patience. Start by drawing up a budget of your monthly expenses and deciding how much you can afford to save per month. You may have to make cutbacks on certain items, but in the end being able to put down a deposit will result in lower instalments and less interest over the loan period, making paying off your loan more manageable.

We have been getting a lot of enquiries from future clients who either are at university or have just started working. All they want to know is about property and the possibility of them owning one one day. Our motto as Mgilija Properties is ‘‘don’t wait to buy property but Buy property and wait’’ and the first step to achieve this is before entering into the property market one should be saving towards a deposit. Buying your first home requires planning and saving. A deposit is very important as it gives potential home buyers the boost they need when applying for a home loan. If you have a deposit to put down, the Banks will take this into account and your affordability score will rise. AdditionalSave for a home deposit We have been getting a lot of enquiries from future clients who either are at university or have just started working. All they want to know is about property and the possibility of them owning one one day. Our motto as Mgilija Properties is ‘‘don’t wait to buy property but Buy property and wait’’ and the first step to achieve this is before entering into the property market one should be saving towards a deposit. Buying your first home requires planning and saving. A deposit is very important as it gives potential home buyers the boost they need when applying for a home loan. If you have a deposit to put down, the Banks will take this into account and your affordability score will rise. Additionally, your monthly home loan repayments will be lowered and depending on the relevant Bank’s criteria, you could be able to apply for a higher bond if you wish. Saving towards a deposit is a simple concept although it can seem difficult depending on your financial situation. However, it is like any investment plan; it takes time and patience. Start by drawing up a budget of your monthly expenses and deciding how much you can afford to save per month. You may have to make cutbacks on certain items, but in the end being able to put down a deposit will result in lower instalments and less interest over the loan period, making paying off your loan more manageable. Renting your first place can be intimidating. These tips for first time renters will help you go out there and flat hunt with confidence.

Renting your first place can be intimidating. These tips for first time renters will help you go out there and flat hunt with confidence. If you’re frequently unable to pay your rent or late with your payment then it’s essential to follow these budgeting tips.

If you’re frequently unable to pay your rent or late with your payment then it’s essential to follow these budgeting tips. A good estate agent is invaluable to buyers looking for their dream home.

A good estate agent is invaluable to buyers looking for their dream home.  …In Customer Service

…In Customer Service It is the landlord’s responsibility to offer a property both ‘reasonably fit’ for the purpose for which it has been let and to ensure the property is habitable. However, the big question remains – is providing security like burglar bars, perimeter sensors, alarms and other forms of security an obligation of the landlord and can a tenant reasonably expect this?

It is the landlord’s responsibility to offer a property both ‘reasonably fit’ for the purpose for which it has been let and to ensure the property is habitable. However, the big question remains – is providing security like burglar bars, perimeter sensors, alarms and other forms of security an obligation of the landlord and can a tenant reasonably expect this? Most of the time you will have a clear idea of when you will be moving homes and have time to plan and make decisions accordingly. However, there are times when life happens and the decision is made for you.

Most of the time you will have a clear idea of when you will be moving homes and have time to plan and make decisions accordingly. However, there are times when life happens and the decision is made for you.